18+ Mass Estate Tax Calculator

Massachusetts estate tax is imposed only on the portion of the estate. Web Massachusetts law about estate taxation Laws regulations web and print sources on estate tax law.

Law Offices Of Boyd Boyd

Web Massachusetts mortgage calculator.

. If the estate has a. Massachusetts income tax calculator. The graduated tax rates are capped at 16.

Massachusetts uses a graduated tax rate which. This table reflects the rates for the 2018 tax year which are the taxes you pay in early 2019. Web Calculate After-Tax Income 59060 After-Tax Income Total Income Tax Federal taxes Marginal tax rate 22 Effective tax rate 1094 Federal income tax 7660 State taxes.

Web The Massachusetts estate tax exemption has been raised from 1 million to 2 million. This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional. Web Online Massachusetts estate tax returns may be filed online through MassTaxConnect.

Zillow has 34 photos of this 949000 3 beds 2. In fact Fairfax County holds a moderate. Web There have been recent law changes to the estate tax for decedents dying on or after January 1 2023.

Web The table below shows the tax brackets for the federal income tax. Web However the amount of any estate tax due to Massachusetts will be reduced in proportion to the value that the non-Massachusetts situs assets bear to the. If you make 70000 a year living in Virginia you will be taxed 10914.

Web Federal tax rates range between 18 and 40 depending on the amount above the 1292 million threshold or exemption amount per person in 2023 or 1361. Web Massachusetts Estate Tax. Web In dollar terms Fairfax County Virginia residents pay quite a bit in property taxes but this is not due to property tax rates themselves.

Web This means if the value of an estate exceeds the 1 million threshold anything above 40000 will be taxed. Web Virginia Income Tax Calculator 2023-2024. Calculate how much youll pay in property taxes.

Web Massachusetts does levy an estate tax. Web Estate Tax Calculator. Massachusetts has its own estate tax which applies to any estate above the exclusion amount of 2 million.

If you are unable to find the information you are looking for or if you have. You will need to create an online account to file the estate tax return. The estate tax is computed in graduated rates based on the total value of.

Your average tax rate is. Web Zillow has 28 photos of this 450000 1 bed 1 bath 694 Square Feet single family home located at 0 18 Bailey St Medford MA 02155 built in 1900. It is assessed on estates valued at more than 1 million.

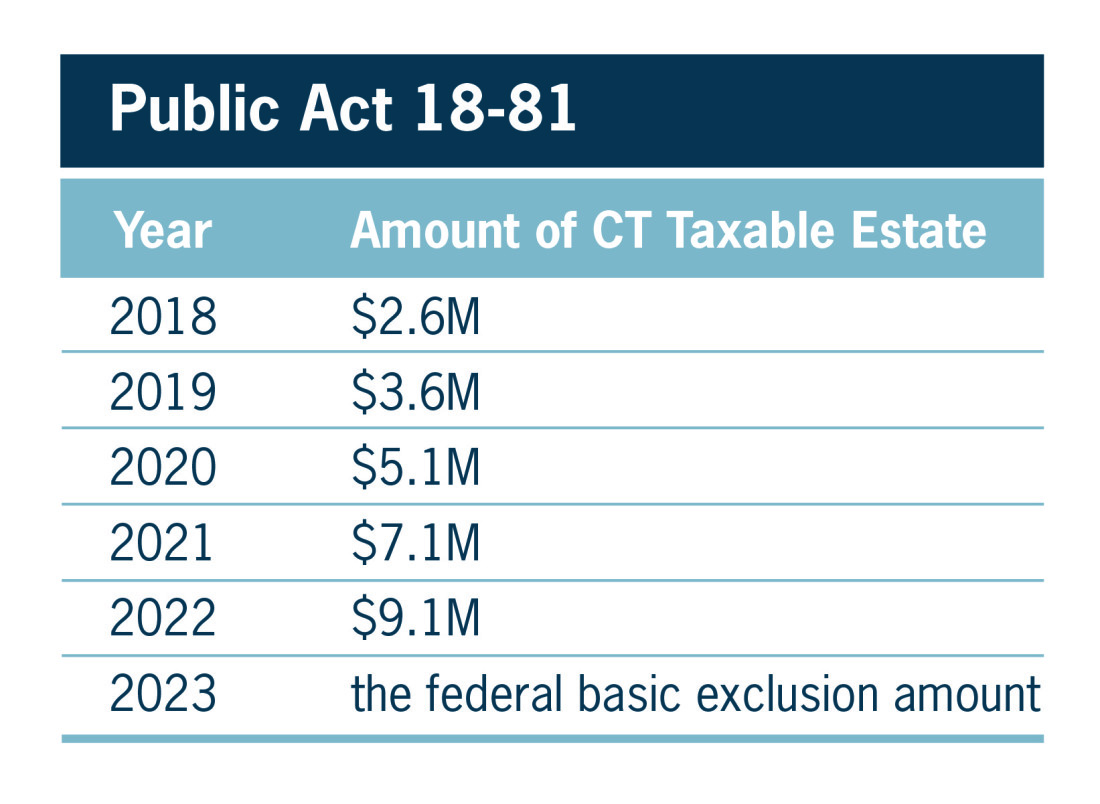

Web Newton Real estate. The new law amended the estate tax by. Web Massachusetts estate tax brackets range from 08 to 16 for estates over 10 million.

Web The new law increases the Massachusetts asset threshold at which the estate tax is imposed from 1 million to 2 million and eliminates the so-called estate.

Smartasset

Ligris

Krost Cpas

Journal Of Accountancy

1

Adroit Financial Planning

1

1

Estate Cpa

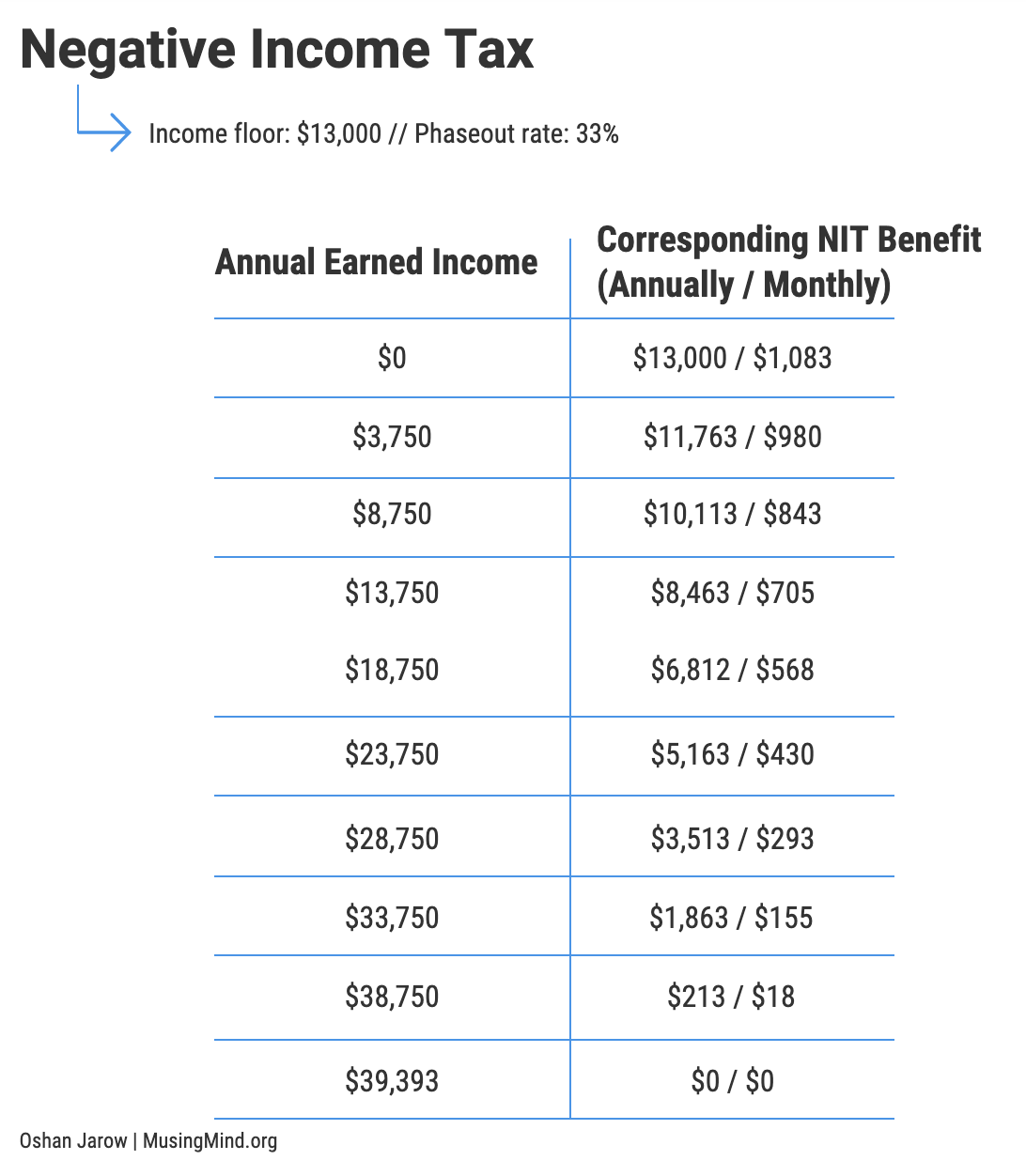

Oshan Jarow Medium

Delaney And Delaney

Pullman Comley

John Hancock Life Insurance Advanced Markets

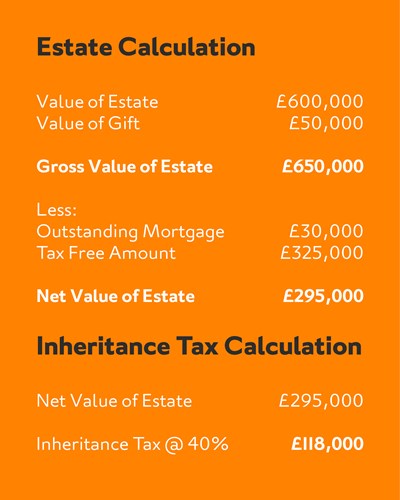

Gov Uk

Smartasset

Wikipedia

Inheritance Tax Calculator